Growth marketing during a recession

They say pressure makes diamonds – I’d say that the same is true for recessions creating amazing startups. Airbnb, Uber, and Groupon are great examples of companies that emerged during the recession in 2008.

How does one build, scale, and navigate the headwinds of a recession when consumer behavior dramatically changes? Not to mention the complexities in 2022, such as privacy degradation (i.e., Apple’s ATT) and post-COVID behavioral shifts.

To fully understand the response to this question, let’s dive into my Triple R model on strategizing and executing during a recession.

The model is simple: reforecasting, reprioritizing, and refining.

Reforecasting your models

It’s no secret that Average Revenue Per User (ARPU) is dropping for companies across the board. A prime example is stock-trading platform, Robinhood, reporting an ARPU decrease of 62%, i.e., $53 compared to its high of $137 during the first quarter of 2021. That’s a massive decline. If Robinhood were once comfortable acquiring users at $137 to break even, they would now be acquiring users at nearly 3x the revenue they bring in.

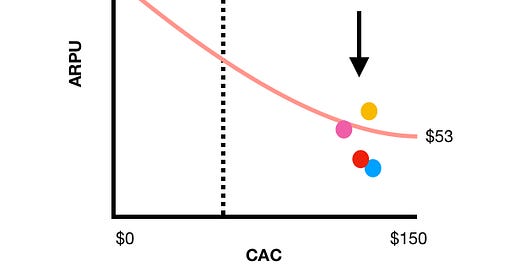

A simulation of Robinhood’s CAC/ARPU by channel. Image courtesy of Jonathan Martinez.

In the above simulation, ARPU drops from $137 to $53. More specifically, the colored bubbles represent channels and their CAC/ARPU relationships. Robinhood was acquiring users in the $130 CAC range and expecting $137 in ARPU. The shift in these channels depict how CAC remains constant while ARPU drops. This type of acquisition is not sustainable and demonstrates what many startups face during a recession due to the softening of consumer demands.

As a result, leveraging COVID-era data to inform ARPU has quickly become obsolete for many businesses.

Instead of relying on longer historical data windows, it is necessary to shift to utilizing shorter windows of data for project revenue. The chart below illustrates how a startup can project revenue using a shorter window.

Projecting startup revenue with shorter revenue windows. Image courtesy of Jonathan Martinez.

By taking new monthly transactions and average revenue per transaction, the Y1 revenue can be computed. This paints a more accurate picture of how much users are now worth to your business.

Using solely 30 days of data is okay as an interim solution and is much better than bleeding through cash.

Reprioritizing growth initiatives

If new channels and major experiments were in the picture, it’s probably best to leave those for when the markets recover. This is the time to double down on the following:

Most efficient growth channels

Owned media (i.e., social, lifecycle, etc.)

Channel optimizations

After reforecasting, there will most likely be a need for reallocating budgets and optimizing channels with a higher CAC than the newly forecasted ARPU. To supplement the decrease in paid acquisition, leveraging owned media such as lifecycle marketing can be advantageous. Instead of heavy discounting (which inherently decreases ARPU), consider messaging that aims to promote referral programs or new product enhancements.

During my time at Coinbase, the recent 2022 “crypto winter” occurred and markets began sinking. Consequently, the growth marketing team swiftly reprioritized projects. Instead of focusing on expensive experiments, the team clamped down on lifecycle marketing to increase user engagement and reactivate churned users. For a company that is worth billions, it showcases that you don’t always have to “acquire at all costs” if it doesn’t make sense.

Refining your growth efforts

There’s no better time to refine your growth marketing tech stack and overall growth efforts than during a slow period. This is particularly important for startups that are struggling with data degradation caused by privacy changes. For example, iOS14 advertisers are at the mercy of modeled conversions on paid channels such as Facebook for ad-level reporting. This has created a massive blind spot in understanding how creative is performing. So, what can be done to improve a marketing tech stack?

Listed below are a few key and timely pillars to focus on when refining a growth marketing tech stack:

Staying up-to-date on new measurement tools

Testing on channels where data is available

New measurement methodologies (i.e., incrementality)

Take the time to understand the tools being built to help combat data degradation, such as Facebook’s CAPI (conversions API). With CAPI integrated, advertisers can send data back to Facebook via S2S (server-to-server) rather than relying on web pixels. This creates a much stronger signal which is less likely to be affected by privacy restrictions.

If you don’t have accurate ad-level data, then this is a great time to test creative, copy, and other attributes where data is available. For example, creative can be tested on owned channels such as lifecycle or platforms like Android or Web. The subsequent results from these tests will help fuel the scale of scarce data segments when it’s time to step on the pedal again.

There’s no perfect marketing tech stack, and even companies like behemoth-Uber have gaps in their data. When I worked at Uber, we had to constantly build formula-rich models to account for data gaps or to improve our forecasting. When new incrementality tests would hit stat-sig, we would immediately leverage that data and add it to our attribution tables as scalars. As you loosen your foot on the gas pedal, you open opportunities for new measurement tests. If we pause Google Ads, how much do conversions decline? How about Snapchat Story ads or TikTok as a whole? If incrementality is battle-tested before it’s time to scale back, the allocation of budgets will be much more efficient.

Looking ahead

Whether it’s doomsday for your startup or it has yet to experience a hint of the recession, there’s no denying that 2022 is different. S&P 500 has dipped 23% from the previous year, Meta’s stock is down nearly 50% this year, and the Fed hiked interest rates by 0.75% -- the largest increase since the 90s.

While all that sounds terrible, many startups have come out of recessions stronger than ever because they’ve adapted to new conditions by reforecasting, reprioritizing and refining their growth efforts. Therefore, it’s important to remember that this methodology is not set-and-forget; but instead, the Triple R should constantly be reevaluated.

If we traveled into the future by a few years, would you look back and say you made the necessary changes during a market downturn?