When you’re scaling a paid acquisition channel you should constantly question whether you’re spending in the most efficient way possible? If you’re scaling your spend across various channels, it’s more than likely that you’re facing rising costs. But how do you know where and when to draw the line?

In this short article, I’ll walk you through when to start measuring diminishing returns and how to use a simple regression analysis to find optimal spend levels.

Weekly performance trends

If you’re scaling any paid acquisition channel by 5-10x weekly, then it becomes more important than ever to maintain the pulse on the following metrics:

Cost-per-thousand impressions (CPM)

Customer acquisition cost (CAC)

Ad frequency (for paid social)

As paid spend scales, the number of impressions being served naturally increases, which causes CPMs to rise. If your CPMs are rising this usually means that your CACs and ad frequency are rising as a byproduct. A Google Sheet with those metrics laid out on a weekly basis will help you identify large upticks in costs, which can then guide your future budget allocations.

Regression analysis

First off, what is regression analysis? In non-technical terms, it’s a way to measure the relationship of one variable to another. This empowers marketers to understand how two marketing metrics relate to one another, such as affiliates signed and conversions, or revenues and paid spend.

If you’re looking to get analytical and have a minimum of 90 days of data at varying levels of spend, a regression analysis is your answer. What’s great about this kind of analysis is that it provides a clear depiction on where your optimal spend is at the paid channel level.

During my days at Postmates, we scaled our driver acquisition budget from less than $50,000/mo. to $3M/mo., and had to run regression analyses on a regular cadence to ensure optimal spend per channel and geography. Below is a quick summary on how to get a regression analysis set up with the following inputs on a weekly level:

Spend

Customer acquisition cost (CAC)

Example data inputs for regression analysis. Image courtesy of Jonathan Martinez.

Once you have this data input on your Google Sheet, highlight all the data and select the Insert drop-down, followed by Chart. In the Chart type area that shows on the right pane of the screen, scroll until you find the Scatter option. Select Scatter. Add “CAC” to the X-Axis and “Spend” on your Series. Finally, go to the Customize tab, find Series, click on it, and then scroll down to find the Trendline toggle.

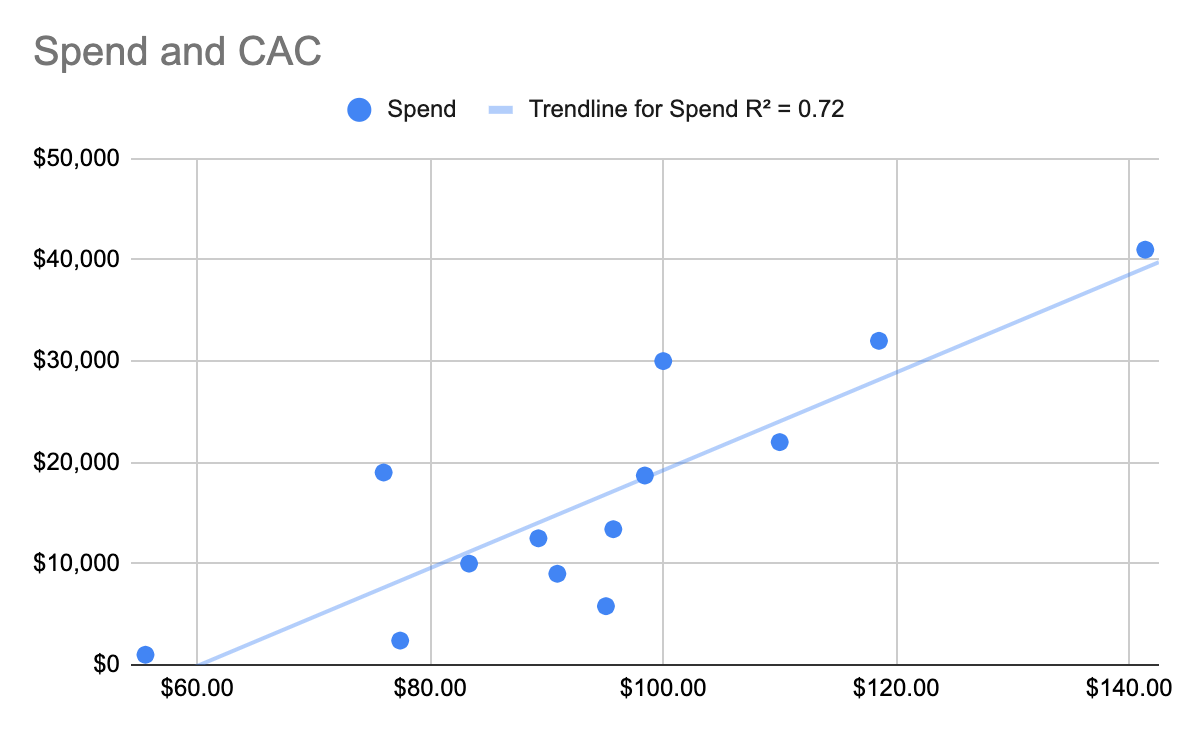

From there, you should have something that looks like what I’ve created below:

Example regression analysis. Image courtesy of Jonathan Martinez.

From this graph it is clear that we have around $90 CAC at spend levels of $5,000 - $15,000. When we spend $30,000, CACs only rise to $100. That’s only one week’s datapoint though, which could have been an anomaly. Ideally, we would prefer to have had a cluster of spend data points at $30,000 in the $100 CAC range.

My next steps based on this data would be to scale to $30,000 in spend to see if we can maintain CACs below $100. A ~10% increase in CAC for a 3x increase in spend levels and conversions would be a great success.

As more data-points start to fill the scatter plot, it becomes much easier to decide on where to draw the line on spend for specific channels or geography. Conversely, it helps to guide the light to where opportunities may be present.

Instead of spending too much on paid acquisition, know that you have the regression analysis’s ability now stored in your growth toolbelt to make more informed budget allocation decisions.

The more useful and much much important metric to understand is marginal contribution and your marginal CAC.

In the illustration you roughly have a $90 CAC for 0-10k and 10k-20k in spend. However the CAC average change to $100 which means for the spend of 20k-30k you paid $110 for those conversations. You then have to understand the business unit economics to ensure that on that marginal acquisition is profitable ( keeping in mind we are past the growth at all costs days and capital is expensive).