The future of web3 and growth marketing

You’ve probably seen the explosion of the once nascent blockchain, non-fungible tokens (NFTs) and metaverse sector over the course of the last year.

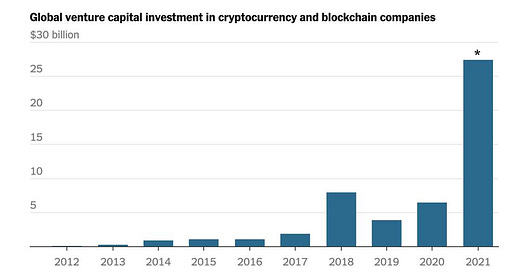

In 2021, over $30 billion flowed into cryptocurrency and blockchain companies. That’s more funding to this sector, than the past eight years combined.

Image courtesy of Pitchbook.

This massive infusion of capital has led to widespread recruitment by these companies for talent, including those working in growth marketing. As of now, growth marketing has yet to radically change, with major pillars (i.e., Meta paid acquisition) still at the forefront of strategy.

With this in mind, I’m going to make several key predictions on how growth marketing is going to adjust over the next few years, as web3 continues to emerge:

Community driven

One of the touted advantages of web3, is that it is user owned. This is accomplished by leveraging tokens and decentralized technology. We are likely to see new social media platforms emerge, which will be tailored around the user having greater ownership over individual content.

Over the last two decades, we’ve seen waves of new social media platforms rise and sometimes fall: Friendster (2002), Myspace (2003), Facebook (2004), and most recently TikTok (2016). Each platform utilized new layers of technology (e.g., TikTok’s video algorithm), to breakthrough and capture widespread public attention.

At the same time, we’ve seen the creation of platforms like Substack, where writers own their email subscription list. This is radically different from YouTube, where a creator’s subscriber data remains locked behind a corporate wall.

By combining decentralized technology with an increasing emphasis on creator ownership, a wave of platforms will be spawned. For growth marketers, this means our industry must adapt quickly.

Changes will likely include a stronger shift towards each consumer becoming their own kind of influencer and earning financial reimbursement for advertising their favored products. We’ve already seen user-generated content (UGC) assets become the latest trend in paid social advertising, where everyday folks are getting paid to record product reviews. These videos are then published on a brand’s advertiser accounts, to boost visibility.

Rewarding consumers

One natural byproduct of users owning their content, is that they will start to earn rewards for simply browsing the web. Brave, a browser which has gained steam over the last five years, is a perfect example of this phenomenon. The browser has its own token, Basic Attention Token (BAT), with users opting to earn BATs by viewing ads.

Another force shifting us closer to this future, is privacy degradation. Both Apple’s iOS14 SKAD, and the California Consumer Privacy Act (enacted in 2018), have established stringent guidelines for startups, when asking users if they can use and share their data.

This is not to say that users will earn thousands just for scrolling a feed. But platforms will utilize forms of compensation in exchange for users sharing their data, profiles, and browsing behavior.

Major social platforms are increasingly investing in their creators through programs such as TikTok’s Creator Fund, which has pledged $1b for its creators. As we shift towards this norm, platforms and brands, will be funneling more funds or exclusive features to consumers in exchange for their information.

Forms of advertising

Easily one of the most exciting parts of the coming web3 shifts in growth marketing, are the likely new forms of ad placement. Think of the shifts of the last decade, where we’ve pivoted from largely untraceable out-of-home (OOH) placements, to hyper-targeted image and video reel ads on social platforms.

Most growth marketers will say that you must be swift, in understanding the ever-changing landscape of best practices across mediums. This will hold true with new platforms, leveraging new device surfaces – e.g., wearables in the Metaverse. With new devices, also comes new ad placement opportunities, which will mold growth marketing’s best new practices. As these devices become increasingly powerful with new chips, they will also be able to support more immersive and 3D advertisements with augmented reality/virtual reality (AR/VR) technology. Snapchat has already showcased the power of their AR filter placements, which can overlay clothing onto their users.

In addition to new ad placements, we’ve seen new tactics for gaining mass traction, e.g., NFTs leveraging large Discord groups and meme-style Twitter feeds. As an example, Doodles (a collection of NFTs) only allowed 1,000 members into their Discord group, which created an exclusivity factor. This tactic created huge awareness for the project, and ultimately led to an influx of people looking to join.

Though these forms of growth marketing may not have staying power in the coming years, it suggests that web3 growth strategies will be ever-changing. E.g., Even while I believe that the brands currently leveraging NFTs will ultimately prove to be a short-term fad, the underlying technology (and proof of ownership) is a more appropriate use-case.

Image courtesy of Snapchat.

Evolving metrics

The advent of new social channels, advertising formats and web3 tactics, will spawn new standards for metrics which will be important to track. The largest trend to monitor would be how

building communities, can potentially impact a brand’s definition of success and allocation of resources. Growth marketers will be forced to become more community-oriented, and track metrics such as community growth, cost per community member, cost per active community member, etc.

A perfect example of this phenomenon would be Starbucks rolling out Odyssey, an updated version of their existing loyalty program with web3 components built in. Their vision is to expand the current Rewards loyalty program, while building a community who can participate in fun events or earn exclusive merchandise. As a growth marketer on this campaign, the metrics would not merely be traditional cost-per-acquisition, and instead would be more focused on the growth of the community. The lines would naturally blur between driving direct sales versus longer-term community growth, leading to referrals and eventual revenue.

What’s the timeline

If focusing strictly on investment activity and 2021’s records for the web3 space, it will likely take a few more years before these startups become ubiquitous. But what we do know for certain, is that cryptocurrencies, decentralized finance (DeFi) and non-fungible tokens (NFTs), are the first web3 applications which have found product-market fit and have been heavily adopted.

With all of this in mind: there isn’t an urgent need for startup founders or growth marketers to plan for these changes right now. We still have a little time. But what will prove fruitful, is staying in touch with trends as users begin to adopt these new devices and behaviors in the web3 world. It’s best to ride this web3 wave, as I believe that it will become the new norm before we know it.